A solid opportunity, especially for international investors looking to expand. Morocco offers more than just a strategic location. It connects Europe, Africa, and the Middle East, and benefits from favorable trade agreem ...

Read more

Opening a company's bank account is an essential step when setting up a business in Morocco. Therefore, each company registered in the commercial register in Morocco must have its own dedicated business bank account.

Self-employed entrepreneurs in Morocco must also have a business bank account for their business.

An essential element for managing your professional activity in Morocco or elsewhere, a bank account contributes to all your payment operations traceability. It also contributes to the instant availability of your money and the domiciliation of your activity's financial operations. A professional bank account also allows you to have many other advantages that we will discover in this article.

Types of accounts, functioning, and bank fees in 2021? This article offers you a series of valuable answers about the professional bank account in Morocco when setting up a new company in Morocco.

The opening of a professional bank account is mandatory for companies registered in the trade register in Morocco. It also allows them to benefit from the automation of many operations, for example, electricity bills and taxes to salary transfers without forgetting social benefits. Therefore, creating a bank account has become a reflex for many when starting a new business.

Note that auto-entrepreneurs are also required to open a professional account. A professional bank account is a mandatory step for any new business in Morocco.

In Morocco, all banks have an online space or a mobile application where anyone can freely access their bank account through online banking. Thanks to this online space, it is possible for anyone to consult its balance, make transfers, validate payments online, and much more operations.

But do you know how to distinguish the different types of bank accounts in Morocco?

There are several types:

In Morocco, all companies can open an account in the local currency: the Moroccan Dirham. This account will be helpful in all their local transactions of any type.

A particular processional bank account is a privilege granted by banks to holdings in Morocco and not registered with the foreign exchange office. Therefore, they can open a particular professional account for specific needs.

This so-called particular account is intended for credit operations ranging from advances of funds from abroad made by the account holder to receipts in Dirhams relating to the Dirham portion of contracts and reimbursements received in Dirhams on behalf of the account holder's employees for social security and insurance benefits.

In addition to credit transactions, the particular account is also used for many operations such as debit transactions, reimbursements for advances of funds from abroad, and all expenses incurred in Moroccan Dirhams.

The transfer of the account's credit balance may be made upon the presentation of documents proving that the account holder is not liable for any unpaid charges to the CNSS and the tax authorities, as well as the provisional acceptance report or document in lieu thereof.

In addition to the particular account, banks are authorized to open their books accounts denominated in Dirhams called group accounts.

The account denominated in Dirhams is used for credit operations regarding the remuneration provided for the contract or works contract. It is also open to debit operations for the shares due to the Moroccan and foreign companies' members.

To open a professional bank account denominated in Dirhams, the holder must present a copy of the "grouping" agreement as well as a copy of the contract. We should note that this type of account is opened on the occasion of contracts or works carried out by a group made up of resident and non-resident entities upon the request of the leader of the Moroccan or foreign company.

The foreign currency bank account, also called the bank account in convertible Dirhams, offers the holder the possibility to make withdrawals in Dirhams or any foreign currency.

The account is also used for direct debits, transfers, withdrawals, remittances, and transfers without value dates.

Suppose it is possible to open such an account personally, as a joint account. In that case, foreign currency bank accounts are not remunerated. However, they offer many advantages.

In addition to the advantages we have just mentioned, the account in convertible Dirhams also allows you to cumulate your tourist endowment, that of your spouse and your minor children.

And that's not all since you will also have the possibility to access your bank remotely via your bank's website on a computer or a mobile.

Moroccans of the Diaspora (MRE) are allowed to open a foreign currency bank account, Moroccans resident in Morocco, and foreigners resident in Morocco.

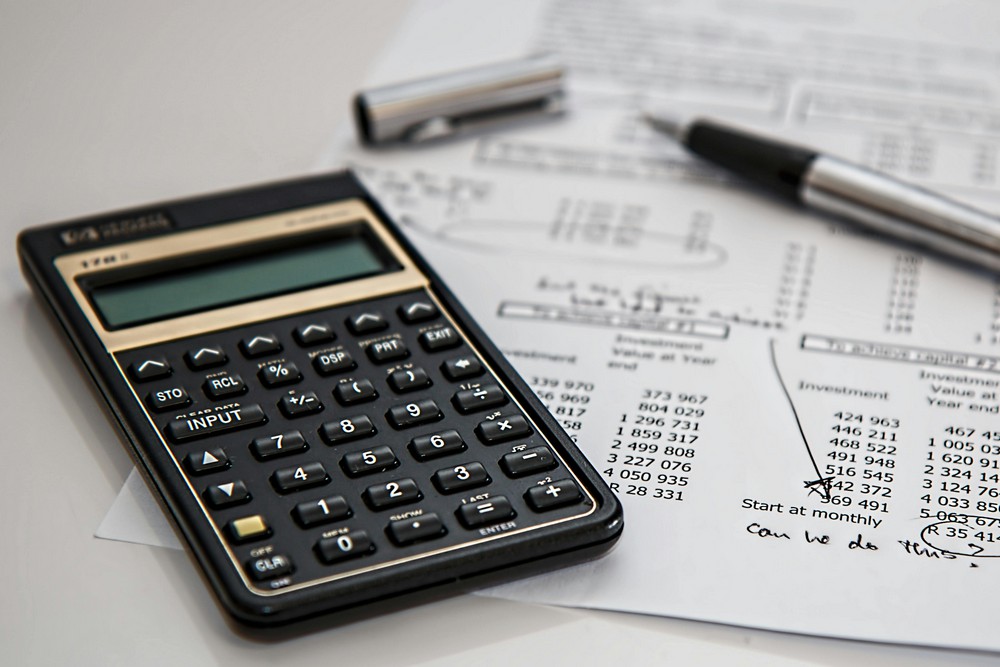

As far as pricing is concerned, account maintenance fees are often free for the first subscription year. Beyond that, you have to count about 15 Dirhams excluding taxes/month of banking fees. The monthly fees will increase if you opt for a bank account with more advantages or better options.

It would help if you asked your bank advisor for more information, as each bank set its fees freely.

In Morocco, even if opening a bank account is relatively easy, whether for individuals or professionals, the fact remains that creating an account is done according to a certain number of steps. To open a professional bank account in Morocco, business owners will have to follow the following steps:

When creating a new company (SA, SARL, SAS Etc.), if you want to register it with a capital greater or equal to 100 000 Dirhams, you will have to go through the step of creating a temporary bank account.

You will then have to create this temporary bank account and proceed with the deposit of capital in the desired amount to continue the stages of the creation of your company (like the domiciliation, the articles of association, etc.).

Once you have placed the capital on your provisional account, the bank will provide you with a certificate of capital deposit. Often, new companies open their temporary account in the bank that will later be their final bank.

On the other hand, this step can also serve as a test for new companies. For example, suppose the banking relationship is not optimal at this stage. In that case, the new company can then define another bank as its final institution.

For our comparison of banks, all Moroccan banks are more or less the same and offer more or less the same services. However, regarding the choice of your new bank, we advise you to choose an establishment close to your company for more facility and time-saving in the future.

It is also crucial to have a good relationship with your bank manager because it will make your relationship more fluid and facilitate some tedious procedures.

For more information on Moroccan banks and those of other countries, you can consult the ranking of the prestigious English magazine The Banker (belonging to the group The Financial Times), which studied all the world banks, including the Moroccan ones.

If you wish to create a bank account as a company, you will be required to provide several documents, such as :

The list below is not exhaustive. It depends on each bank's guidelines. Banks are likely to ask you for other documents, but this gives you an idea of the necessary documents to gather.

Despite their more flexible status, entrepreneurs will have to send their bank the exact documents to open a professional bank account.

As you can see, creating a permanent bank account is not done with a simple snap of the fingers. Instead, the procedure may take a few hours or even days once you have gathered and submitted all the necessary documents to your bank.

Before meeting the branch manager to open your account to sign the contract documents, you must carefully choose your bank.

At this level, you can ask for a convertible bank account (in addition to a classic bank account in Dirhams) which will allow you to deposit a foreign currency. The bank will convert this amount into Dirhams on the same day.

Once the bank account is opened, you can deposit the minimum required amount before issuing a bank card. You can use this bank card in all ATMs in Morocco. In addition, the bank account and your bank card will allow you to make other operations such as receiving your salary, having your bills debited, making online transfers, paying via an external payment terminal, consulting your debit and credit balance directly on the bank's website, Etc.

Companies managers who have just opened a professional bank account in Morocco should check if they have all the elements they may need ( such as bank cards, checkbooks, access codes to the bank's website, Etc.). Then, if necessary, do not hesitate to ask for them directly to the bank advisor that has been assigned to them.

A bank account is a contract between the bank selected by the company manager and the manager of this company (who can also have a self-employed status).

Almost everyone has one or more personals bank accounts. They do not have the same uses whether one is a natural person or a legal entity. A business bank account is very different from a personal bank account in several ways, as seen above.

Essential in daily life for an individual, a bank account is mandatory for every company in Morocco for many reasons, and we have seen them in this article.

Even if it is pretty easy to open a bank account as an individual in Morocco, when you have the status of a professional, the steps and documents to provide are more tedious.

A solid opportunity, especially for international investors looking to expand. Morocco offers more than just a strategic location. It connects Europe, Africa, and the Middle East, and benefits from favorable trade agreem ...

Read more

Plenty of reasons to consider it. Morocco is growing, well located, and actively attracting investment. For both locals and international investors, the country offers real business potential. But getting started means g ...

Read more

Expanding into a new market isn’t just about locking in your strategy or chasing growth. You also have to follow the local rules, especially when it comes to accounting. For any company doing business here, knowing the ...

Read more